About Lake Street Capital Partners

Lake Street Capital Partners (“Lake Street Cap”) is a Chicago-based private equity firm founded under the broader Lake Street network, which includes a $1B+ Registered Investment Adviser, Lake Street Private Wealth. Their strong track record for creating customized portfolios for high-net-worth families, institutions, family offices, and foundations highlighted the founder’s priority for pursuing disciplined, transparent, and client-focused services as they extended their platform into the private equity arena.

With the launch of Lake Street Capital Partners Fund I, Lake Street Cap expanded its offering to include direct access to institutional-quality private market opportunities. The new Fund provides clients with the benefits of greater diversification and long-term value creation, along with access to unique, non-correlated investments and the potential for enhanced returns.

To support this evolution, Lake Street Cap sought to elevate its operational infrastructure—moving beyond ad hoc tools like Excel and email. Their goal: deliver a professional, transparent, and seamless experience that matches the sophistication of their private equity strategy and investment acumen.

The Challenge: Tight Timeline, High Expectations

The principals of Lake Street Cap had extensive experience in fundraising and deal-making within Commercial Real Estate. Within the past few years, they raised capital for multiple SPVs invested directly with Real Estate sponsors around the country. As they evolved into traditional private equity, the team recognized that scaling their platform required more than spreadsheets—it required automation, audit readiness, and a professional-grade investor portal.

Key pain points included:

-

- Lack of a centralized investor portal

-

- Manual capital call and distribution processes

-

- Fragmented communication methods

-

- No easy way to track investor engagement or requests

Lake Street Cap required a partner to meet their tight timeline with operational and professional needs without adding headcount or compromising quality.

The Solution: Purpose-Built Tech, Delivered Fast

After evaluating a dozen vendors, Lake Street Cap selected Ark for its modern interface, back-office automation, and investor-friendly experience. Ark’s ability to quickly onboard historical data and configure a custom-branded portal gave Lake Street Cap the confidence to scale investor engagement without increasing operational overhead while also gaining operational efficiency.

What Ark gives Lake Street Cap:

-

- Institutional-grade investor portal – Branded, secure, and easy to navigate

-

- Integrated general ledger (ArkGL) – Full accounting functionality alongside their third-party fund admin

-

- Flexible document management – Streamlined delivery of capital calls, quarterly account statements, and distributions

-

- Scalability – Future funds and SPVs can be added, with a unified view for LPs across all vehicles

-

- Simple, forecastable pricing – No hidden fees

Implementation: Up and Running in Just 6 Weeks

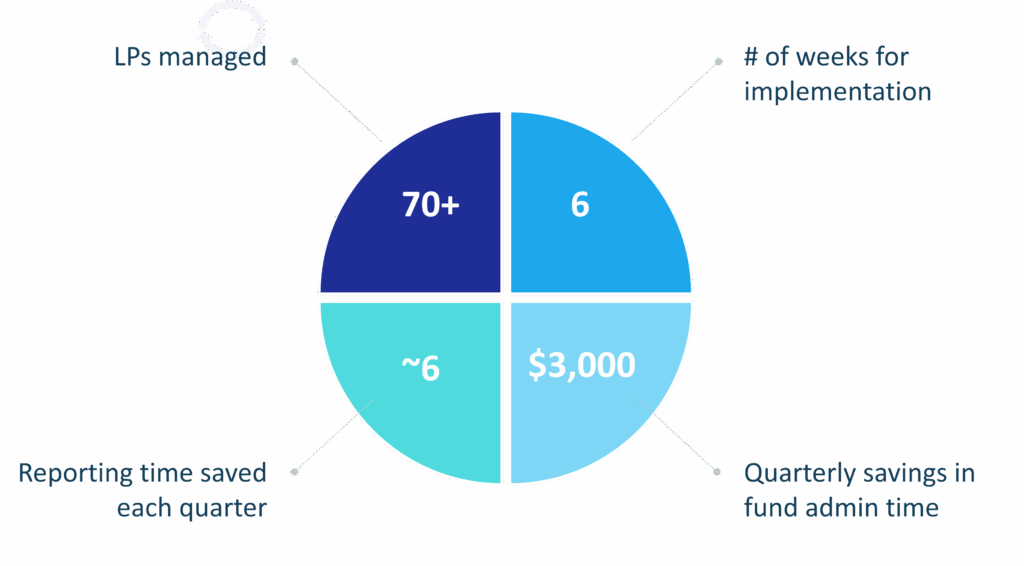

Lake Street signed with Ark in June 2024. It successfully launched its investor portal and first capital call statement by the end of July, achieving a fully operational rollout in just six weeks, significantly outpacing typical industry timelines.

Implementation Highlights:

-

- Historical data uploads enabled full continuity for the new Fund

-

- Branded experience gave LPs a seamless, professional portal

-

- Minimal learning curve for internal users and their third-party admin

- Bank feeds and pre-mapped GL eliminated manual workflows

The Results: Scaled Operations Without Added Headcount

“Our LPs range from sophisticated family offices to first-time private equity investors. We were seeking an investor portal that had the capability to reach both audiences. Ark is built on modern technology, as opposed to a legacy system, which allows us to customize data and information shared with our investor base. The portal has a very clean, user-friendly dashboard.”

— Justin Terzo

Final Takeaway

Lake Street Cap represents a new generation of private equity managers: agile, investor-focused, and committed to operating at an institutional standard from day one. With Ark, they established a professional-grade infrastructure in just six weeks—a timeline that would have been unthinkable with most legacy platforms.

Ark provided more than just technology; it delivered a fast, intuitive, and flexible solution that allowed Lake Street Cap to launch confidently, streamline operations, and enhance the investor experience while laying a solid foundation for future funds.